Accounting Package

Accounting package all about tools and techniques required to keeping records of different commercial transactions. This course include different data analyzing tools, data entry tools, Tax form filling and fundamental of banking system.

Module 1

-

-

- Basic Concept of Computer

- English Typing

- MS Word, MS Excel, MS PowerPoint

- Advance Excel

- Data Entry

- Internet

- E-Banking

-

Module 2 Introduction to Accounting

-

-

- Theoretical framework

- Basics of Accounting

- Introduction to Tally Prime and Busy Software

- Maintaining Security Protocol

- Backup and Restore

- Company Data

- Importing and Exporting Data

- Audit Trail

- Adjustment Entries

-

Module 3 Tally Prime – Accounting Processes

-

-

- Purchase and Sale Vouchers of Goods with GST

- Purchase and Sales with Trade/Cash Discount

- Separate Actual & Billed Quantity

- Stock Transfer with Godown Management

- Purchase and Sales Order

- Debit & Credit Note Processing

- Contra Voucher Management

- Rejection In & Out Notes

- Alternates and Compound Unit of Quantity

- Multiple Price Levels

- Batch Management with Manufacturing and Expiry Date

- Cost Tracking

- Management of Fixed Assets With Depreciation

- Post Dated Payment & Receipts

- Cost Centre & Cost Category

- Bills of Material

- Final Accounting

- Printing Reports

- Bank Reconciliation statement

-

Module 4 Busy – Accounting Processes

-

-

- Setting up a Company

- Basic Configuration, Features and Options

- General Account and Inventory Management Exercises

- Master Creation(Account, Item, Units)

- Transaction(Sale, Notes, Purchase, Transferring) with Shortcut Keys

- Printing Document and Their Displaying

- Parametarized Details

- Interest Calculation

- Multi Currency

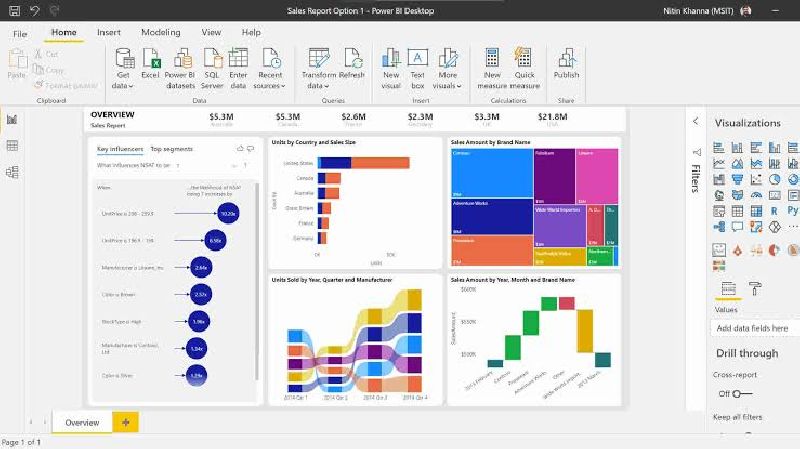

- Reporting and Printing of Invoice

- Managing Data, Backup, Restoring and Data Export

-

Module 5 Taxation

-

-

- Income tax Act

- ITR-1 & Other Type of ITR GST

- Residence & Scope of Total Income

- Heads of Income

- Income Tax Law

- Assesses

- Assessment Year

- Person

- Steps of Computation of Total Income

- Slab Rates of Income Tax

- PAN Number

- TAN Number

- TIN Number

- Form 16

- DIN Number

- ITR Types and Applicability

- E – Filling

- HSN SAC Code

- GSTIN

- TDS Filling

- TDS Certificate

- TDS Form 24Q

- Form 26Q

- TCS Return

- 27EQ

- GST E – Filling

- GST System

- Frame Work

- Tax Rate

- Compensation Cess

- GST Challan

- PMT 06

- PMT 07

- GSTR 1

- GSTR 2

- GSTR 3

- TCS and TDS Handling

- Advanced Payroll

- GST on Services and Items

- GST on Voucher Level

- GST on Reverse Charge Mechanism(RCM)

- GST Received in Advance

-

Module 6

-

-

- English Speaking

- Personality Development

- Interview Preparation

- Job Skill Training

- Resume Guidance

- Basic concept of Hardware

-